Tax advice for pensions

Hazel Bowen, Senior Wealth Planner, explains how expert pension tax advice can help you optimise contributions, avoid tax traps and make informed choices for a secure retirement.

Senior Wealth Planner

3 Sept 2025

|Please note: This is based on current rules and legislation in the UK only.

Quick summary: Pension tax advice

Pensions aren’t just about building wealth for retirement, they also come with important tax rules that can help reduce your tax bill. Hazel Bowen, Senior Wealth Planner discusses how expert planning and pension tax advice can help optimise your pensions and retirement income.

- Why save into a pension?

Pension contributions receive income tax relief, meaning you can save from pre-tax income. For higher-rate taxpayers, a £10,000 contribution may only cost £6,000, making pensions highly tax-efficient.

- What are the common traps to avoid?

Key traps include exceeding the annual allowance (£60,000 for most people), triggering the tapered allowance for high earners, or gradually losing your personal allowance once income passes £100,000.

- What is the carry forward tax rule?

Carry forward lets you use unused pension allowances from the previous three tax years. This allows larger contributions in the current year while still benefiting from tax relief.

- How to make tax part of a retirement plan?

Tax planning should shape both saving and withdrawal strategies. Using cashflow planning, tax allowances and pension rules ensures you balance contributions, income and investment growth for a secure retirement.

- How does accessing a pension affect your tax bill?

Normally, 25% of your pension can be taken tax-free as one or more lump sums, with the rest taxed as income. Drawdown offers flexibility to manage withdrawals within tax bands, while annuities provide guaranteed income but are fully taxable.

- What are the changes to inheritance tax (IHT) and pensions?

Currently, pensions are usually excluded from your estate for IHT. From April 2027, pensions will be included in the IHT net, making it vital to review estate and wealth transfer plans.

Why bother saving into a pension?

Fundamentally, the aim of saving into a pension is simple: to ensure you have enough money to stop working and enjoy retired life.

Auto-enrolment into a private pension scheme has played a vital role in helping more people start saving, but the default contribution levels - 5% from the employee and 3% from the employer - are unlikely to be enough to fund a retirement aligned with most people’s imagined lifestyle.

Many people assume that because it’s the default, it must be enough. But without proper education or guidance on how much is truly required, they risk under-saving during their working lives.

The tax advantages of pension contributions

Pensions remain one of the most powerful, tax-efficient ways to save. When you contribute, you receive income tax relief. This means you can put money into your pension without paying tax on it first, or you can reclaim some tax you’ve already paid - either automatically for basic-rate taxpayers or through a tax return if you pay higher rates.

That means a gross contribution of £10,000 might only cost £6,000 for a higher-rate taxpayer (40%). For those earning over £100,000, there’s a unique tax trap: your personal tax-free allowance is gradually reduced once your income goes above £100,000. This can mean you pay as much as 60% tax on income between £100,000 and £125,140. By making pension contributions, you can reduce your taxable income, restore some or all your allowance and avoid this extra tax.

Avoiding the common tax traps

For all their advantages, pensions come with complexity and pension tax planning is very detailed. One common area that catches people out is the annual allowance - the maximum amount you can contribute to your pension each year while still receiving tax relief.

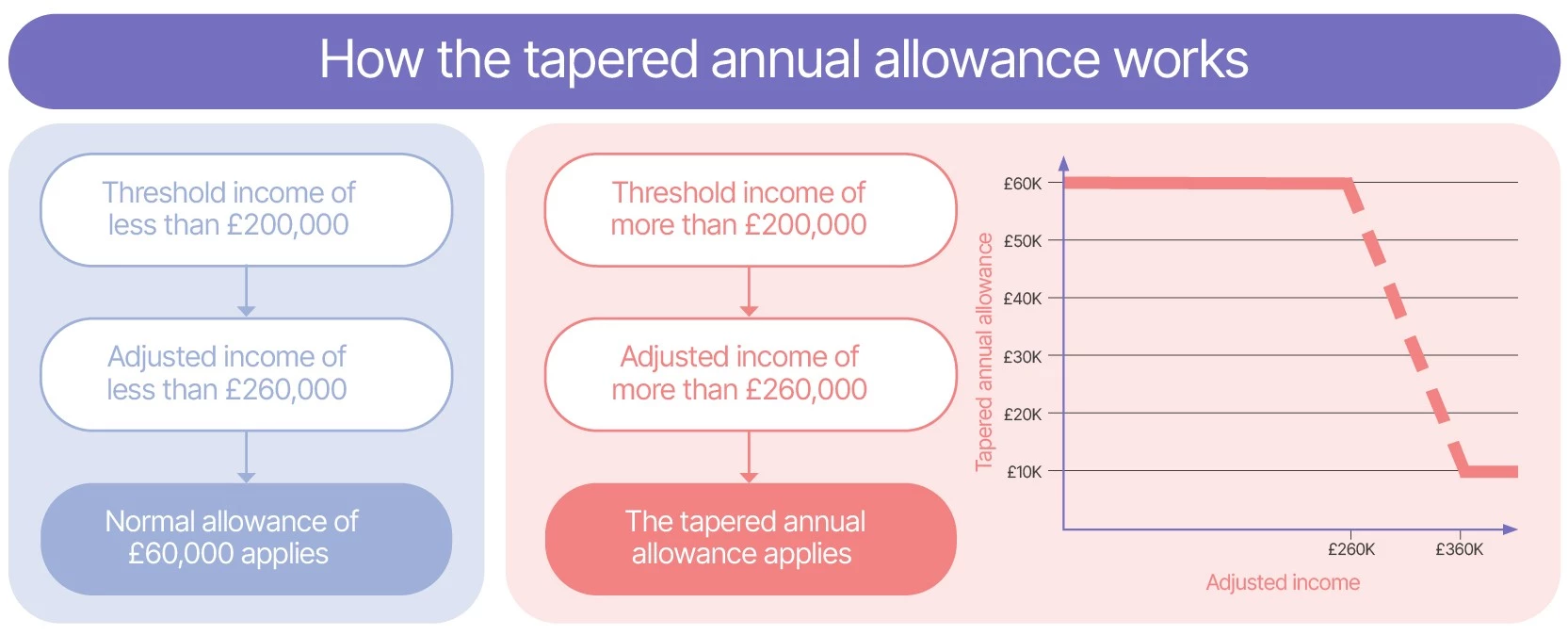

For most people, that figure is currently £60,000 or your earned income, whichever is lower. But for higher earners, the rules become more complicated. If your threshold income exceeds £200,000 and your adjusted income is over £260,000, your annual allowance may be gradually tapered down to as little as £10,000. This is demonstrated in the infographic below.

Using 'carry forward' to make larger contributions

If you haven't used your full annual allowance in the last three tax years, you may be able to carry it forward, allowing you to make a larger pension contribution in the current year.

For example, someone earning £120,000 who wants to contribute £100,000 into their pension could do so by using the current year’s £60,000 allowance and then drawing on unused allowances from the previous three years.

This rule is particularly useful for individuals who have recently become subject to the tapered allowance but still want to boost their pension before retirement.

Retirement tax planning advice

As you get closer to retirement, pension planning becomes less about how much you can contribute and more about whether your savings are on track to support your intended lifestyle.

This is the stage where a cashflow plan becomes invaluable - a way of looking at what you have, what you expect to receive (including your State Pension) and what you’re likely to spend.

Much of your pension will be invested in the markets, usually through a default fund if you’re in a workplace scheme. Being invested is a good thing - it gives your savings the potential to grow faster than inflation - but your investment approach and amount of risk you can afford to take will be influenced by when you intend to retire.

If you’re approaching retirement and thinking about withdrawing from your pension, it’s important to plan to ensure the risk profile is aligned to your goals and timeframe. Tax and retirement planning at this stage is crucial.

Drawing from your pension and your tax bill

When it comes to accessing your pension, there are two options: drawdown and an annuity. Both come with tax implications.

Typically, 25% of your pension pot can be taken tax-free from age 55 (soon to rise to 57) - either in one or more lump sums. The remaining 75% is taxed as income at your usual tax rate.

If you choose to buy an annuity, you’re exchanging your pension pot for a guaranteed income for life. This income is treated like any other, it’s added to your total income and taxed accordingly. An annuity can provide valuable certainty, but the decision is irreversible, so advice is key.

Alternatively, drawdown allows you to leave your pension invested and withdraw money as and when you need it. This gives greater flexibility. You can manage how much income you take each year to make use of your personal allowance or remain within a lower tax band. You can also adjust withdrawals if your circumstances or other income sources change, helping to reduce unnecessary tax and keep your plan on track.

Crucially, funds in drawdown remain invested, which means you still need to consider your investment strategy. What’s appropriate in your 50s may not be right in your 70s and working with an adviser can help you strike the right risk-reward balance.

Inheritance tax (IHT): the coming changes and what they mean

Pensions have long been used as a tool for IHT planning, largely because they’ve been excluded from the taxable estate on death.

Currently, if you die before age 75, your pension can be passed on tax-free to a nominated person, whether or not they’re a dependant.

If you die after 75, the recipient pays income tax on withdrawals, but the pension still avoids IHT. That will soon change. From April 2027 pensions will be included in the IHT net. This represents a major change in how pensions are treated for passing wealth between generations.

For clients who have built up substantial pension pots with the aim of passing them on, this is a crucial time to revisit plans to pass on wealth tax-efficiently.

Pension and tax financial advice

A pension is not just a product; it’s part of a wider financial plan. When working with clients, we don’t just look at the pension in isolation. We consider other savings, ISAs and investments to see how we can best help you to achieve your goals.

Our job is to help you take advantage of available allowances, avoid tax traps, create flexibility and unpick some of pension’s complexities.

Those with high incomes or multiple pension pots often face the greatest complexity. They’re more likely to trigger tapered allowances, exceed annual limits, or miss out on carry forward opportunities.

They may also face decisions around consolidating pensions, accessing them in the most tax-efficient order and planning for legacy.

With more rules and more money at stake, there is greater potential for error and greater value in seeking advice.

Ultimately, you know your life best. We’re here to help you think long term, navigate complexity and make smart, informed choices.

New to Canaccord?

If you are new to wealth management and would like to learn more about the themes and details in this article, we can put you in touch with our team of pension tax advice experts.